- Shadownomics

- @shadownomics

- kazonomics.com

- Twitch Livestreams

Tweet Archive for January 2019 « page 5

When peeps take 1 min to read 10 years of work that’s a #footprint of behavior. Don’t be in such a rush to show how smart you are or you might make a fool of yourself faster than you planned #patience is virtue & #bias is a killer 👁

This is overly simplistic and ignores how Gold behaves in different phases of the cycle. When $DXY goes down, Gold will go up. We will see in a few months…

— Peter Ryan (@Pulpisafiction) January 19, 2019

RT @JerseySmile4: @shadownomics @JeffBezos Twitch already taking Netflix’s market share man, your analysis for the future is bar none bro

@psycho_sage @Pulpisafiction @PeterSchiff @realDonaldTrump He replied in less than a minute to a decade of work that encompasses the greatest market calls in history…don’t debate people like that or you will lose to their bad habits. That guy goes on the other side of the trade it doesn’t matter what he thinks cuz he doesn’t think 😈

Conveniently leaving out #gold decline last 7.5 years, massive outperformance by equities & realestate during last 20 yrs. The #hodl mentality is for noobs, #bias is a killer & the same mistake killed crypto bugs during #Ltcwinter learn to admit you are wrong @PeterSchiff 👿

How do you figure? 20 years ago gold was under $300 per once. It's now almost $1,300, and headed much higher.

— Peter Schiff (@PeterSchiff) January 19, 2019

@BTCBakunin Didn’t forget no not enough space but figured the point was made well enough for those who know the entire narrative such as yourself 😈

When the boob who left USA unprotected during 9/11 & oversaw the greatest attack on US soil during his time in office ends up being the voice of reason you know everyone else has lost their collective minds in Washington D.C. 👁 #perspective

When a real #predictiveanalyst shows up & you realize you’ve been dealing with fakes the entire time 👁

#perspectivematters #timingmatters

😈 #shadow

🔮 #oracle

☔️ #weatherman

You just cannot duplicate accuracy ⚛️

#value #scarcity #ruleoftheatom 💜 pic.twitter.com/m3F9jcv6Bt

RT @shadownomics: @RonnieMoas If #crypto wants to move forward it has to rid itself of its past & come together as a community outside just…

@RonnieMoas If #crypto wants to move forward it has to rid itself of its past & come together as a community outside just shitposting to remove people who’ve demonstrated a clear lack of common decency or regard for the well being of others in the pursuit of their own ambitions 👿 #frauds pic.twitter.com/jGlZChOnl4

@RonnieMoas Blocking us changes nothing you are a case study in what a market fraud is & the 😼 is already out of the bag chuckles. You have caused millions in damages to families around the 🌎 & it’s up to everyone else to make sure you are not able to continue dealing ☠️ & destruction 👁 pic.twitter.com/8M6Pyk8eQU

RT @DaDigitalDash: @shadownomics @kazonomics 🙌🙌 been going back and forth on your blog since ’14. Glad to see this material on Twitter, and…

#Emoji cycle map logic application 😈

This chart & map was posted by @winternomics in real-time for “darkest before dawn” #back2thefuturefractal 🔮🔮 #singularity catch & release 👁 #btc

“Price are peeps & peeps are prices” -☔️ pic.twitter.com/DKnc5Sh1W3

@lukastasi It’s a philosophy built over time by taking note or various systems & recognizing similarities in each. Have a detailed memory & habit dealing with info since childhood that’s foundational to way we process things but haven’t really discussed with anyone outside trading channels

@lukastasi All blog post on Kazonomics.com/blog are worth reading along with the Truth of Btc 3 part series on that site 😈

Tfw #fractal logic finally makes sense 😈 pic.twitter.com/64Mr2bgnR0

RT @shadownomics: @RonnieMoas Before anyone goes near new service they should probably ask what happened to old one. Bankrupt subscribers,…

@RonnieMoas Before anyone goes near new service they should probably ask what happened to old one. Bankrupt subscribers, culpable negligence by own admission, failure to carry about basic fiduciary responsibilities #crypto may not be regulated yet but you should be 👿 #DIG deleted tweets 👁 pic.twitter.com/aOnUijxNd6

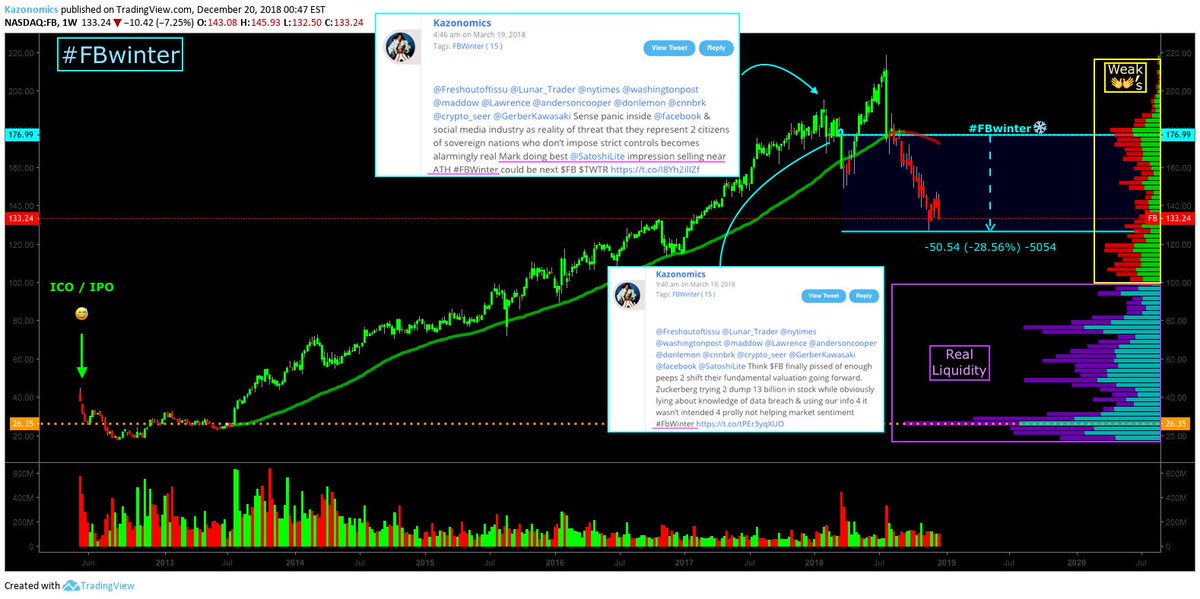

@Crypto_Tech_Fan The market cycle chart is older check the date at the top it was just our version of for BTC. The goldcycle chart that is in the pin post thread has most up to date info on Btc we have posted you should also see #back2thefuturefractal 🔮🔮

This post was to explain 2b & flags 😈

@dag0b3rtt Highly correlated to gold & overcrowded trade full of the same long only metal bugs getting rekt with the collapse since April 2011 waiting on Armageddon to happen to pay them back & unwilling to say they got it wrong ever. Same mentality as crypto hodl’er that got rekt 👿

@btcboxer Like all trends calling the end is always dangerous so best way to play is have a risk adjusted approach that you can align with the trend which will give you better probabilities of success than betting against the tide 👁️

@JerseySmile4 Hoping for rekt or hoping for lambo is the same hope 👿

My apologies annotation did not save reposted palladium chart 👁️

#Gold has been declining for 7 years & is clearly in a bear market but many focus on that as the only hedge on the equity markets while ignoring non-precious metals key for industrial production 😈🔮☂️

#ruleoftheatom #palladium #timingmatters #allassets #onelogic #spacedick 🍆 pic.twitter.com/9kSmUMqiSO

@PlusDT USA is booming and electric vehicle and components are also huge demand on palladium. Likely see it get even crazier when 5g brings about even greater demand on component manufacturers 👁

RT @PrimitiveAI: @shadownomics Man still remember we discussed Palladium in our concept call back in summer during that shockwave.. 🔥call

@TheBeans8 @dag0b3rtt No you just did not read what this post is about. There are plenty more post on wall if you did read first before posting. If you do not understand ask a question do not insinuate we do not understand our own work how rude is that seriously. Spam the thread again = block 👿

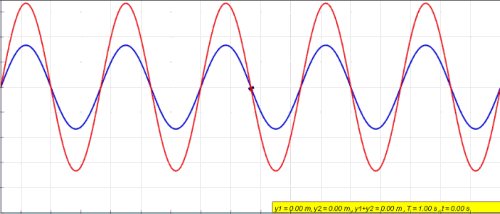

Nodes straight lines interoperating waves & circles in quantum space 😈🔮☂️

#perspective #resolution #scalar #fractal #dimensions #wavelogic #bft pic.twitter.com/WAgjYrs0iM

Interoperating waves & nodal alignment 😈 pic.twitter.com/lQg4uzNjhF

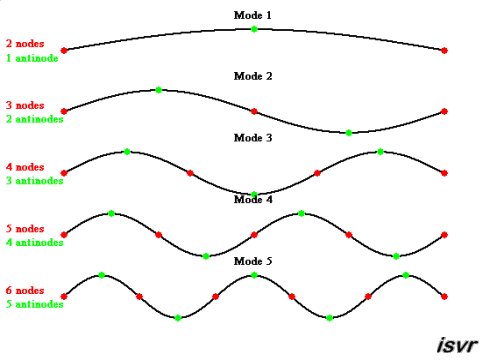

Wave mode vs node vs antinode 🔮 pic.twitter.com/tigNmvjEBO

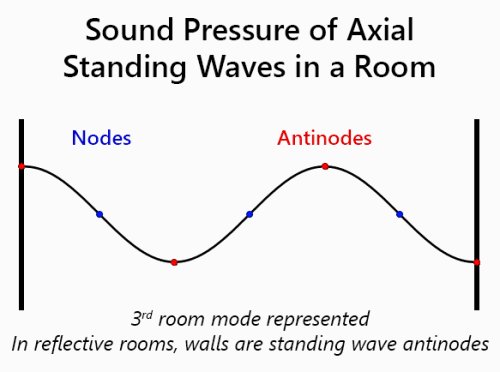

Node vs Wave vs Antinode 👿 pic.twitter.com/6jlM3tplci

Nodes in space 👿 pic.twitter.com/7BSWtYGg6P

The universe at the quantum level 😈 pic.twitter.com/TZwY1D1RJ8

RT @crypto_sim: No need to over complicate your process pic.twitter.com/I5mDbFQ54d

RT @dynamicvol: 14 consecutive red candles on the $VIX daily, incredible pic.twitter.com/LXB7kSIRNs

@generic_fatalis @kazonomics This is nov 2017 if it wasn’t so hard to understand majority of market would not have died post dec 16th 2017 #ltcwintet. Hindsight is 20/20 this was posted on the way up to the climax & shows #crypto had ample warning & chose their fate out of greed which is the #crascycle 😈

🔮Nov2017 @kazonomics posted direct admission of what futures are actually intended to do for #crypto to let them know wtf #CME CASH SETTLED U WILL NOT GET ANY GOD DAMN CORNS CONTRACT’S ARE REALLY FOR 👿

It’s never different this time & more importantly it’s also not about you😈 pic.twitter.com/mkyJSGke3R

“We live in an infinite #universe with an infinite number of #fractal divisions. There is no beginning or end.” – @NassimHaramein 👁 pic.twitter.com/d9FY587PqE

@JerseySmile4 They thought 100 mill & billion dollar funds thought same as them & would buy bitcoin from them at 20k too. The important thing is to recognize the behavior of sheep & there is no debating empirical evidence of their movements. #perspectivematters just as much as facts 😈 pic.twitter.com/ADzUXTPXS8

Worse mistake 🐑 make is think everyone else makes their decisions the sam way they do 👿…Sophisticated traders & funds capable of taking this trade are notoriously good at hedging risk which means its not likely this was the only play made in this trade this story = 🐑 food 😈

A trader sold 19,000 puts on the S&P 500. As long as the index doesn't fall more than 22%, then the trader will make $175 million in premiums. But if the S&P 500 falls 34%, then the trader will lose $558 million. https://t.co/cY2EHJoCoP

— Eddy Elfenbein (@EddyElfenbein) January 14, 2019